A New Era of Identity Security

D-Risk ID by Oneytrust redefines identity security with a seamless integration process.

As generative AI, deepfakes, and synthetic identity fraud rise, traditional solutions like KYC are not just becoming outdated—they’re turning into security liabilities. D-Risk ID goes further, leveraging proprietary algorithms to analyze not just the data but its contextual coherence.

Trusted by Europe’s leading retailers and financial institutions

Synthetic Identity Fraud and D-Risk ID

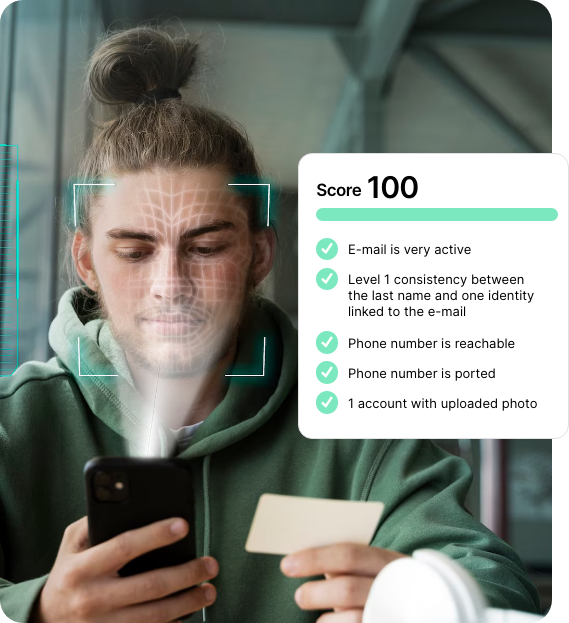

Synthetic identities, blending real and fake identity elements, now account for 85% of successful fraud cases. D-Risk ID quickly detects such fraud by analyzing minimal data inputs like phone numbers, device IDs, and email addresses. If additional data is provided, the system creates an even more accurate profile—all in milliseconds, without impacting the customer experience.

Gartner Insight:

“By 2026, deepfake attacks will lead 30% of enterprises to abandon authentication solutions like facial biometrics.”

— Akif Khan, Gartner Analyst

Why Choose D-Risk ID?

- Go Beyond KYC

Elevate your onboarding security by adding an extra layer of fraud protection. - Synthetic Identity Discovery

Identify and dismantle synthetic identities by cross-validating individual data elements. - Regulatory Compliance

Built with GDPR compliance and approved by the French Data Authority. - Real-Time Results

Integrates seamlessly for instant identity verification. - Easy Integration

Start detecting fraud within hours using only five essential data points. - Comprehensive Fraud Suite

Extend beyond identity validation with the full D-Risk suite, including transaction, return, and refund fraud prevention.

Discover D-Risk ID’s secret weapon – real identities

For French and European-based businesses D-Risk ID can offer access to a live, updated and validated consortia database of millions of real identities. As a stet-up validation when needed, D-Risk ID can make a further check to see if the identity matches an active identity of a customer of many of Europe’s leading retailers and banking institutions.

D-Risk ID When you need to be as sure as can be.

Who benefits from Oneytrust’s D-Risk ID?

When identity is key to your business D-Risk ID is ideal. Banks and fintechs in particular require a solution like this to manage their key risks. For E-commerce businesses we recommend D-Risk Commerce (link) but D-Risk ID can be a great place to start to get immediate value from working with Oneytrust.

Meet your new fraud team

At Oneytrust we have been fighting fraud for Europe’s largest eCommerce businesses for 24 years. Our crack team of “DarkSpies” trawl the dark web for new or specific threats to our clients. Our account team works with clients to really understand the threatspace. All of our data is stored in Europe. Together with our merchants and finance partners we make an unbeatable team.

Let’s face fraud together

GDPR:

Compliant by design

At Oneytrust we build our products to be GDPR compliant from the ground up and ensure fully compliant processes. The industry is aware of vendors and financial institutions putting themselves at risk by using suppliers that do not put GDPR at the core of their activities.