The BNPL Boom is Attracting Fraudsters

The rise of Buy Now, Pay Later has been matched by a surge in fraud. BNPL now represents 7.1% of e-commerce payments

in France. Fraudsters exploit the system using synthetic IDs, payment abandonment strategies, and complex return frauds.

Synthetic or falsified identities

Evaluates transactions in real time using multiple signals

Initial payment success followed by defaults

Validates customers against an exclusive, trusted network

Fraudulent return requests made through BNPL providers

Flags coordinated attacks across retail network

Smarter Detection for Faster, Flexible Payments

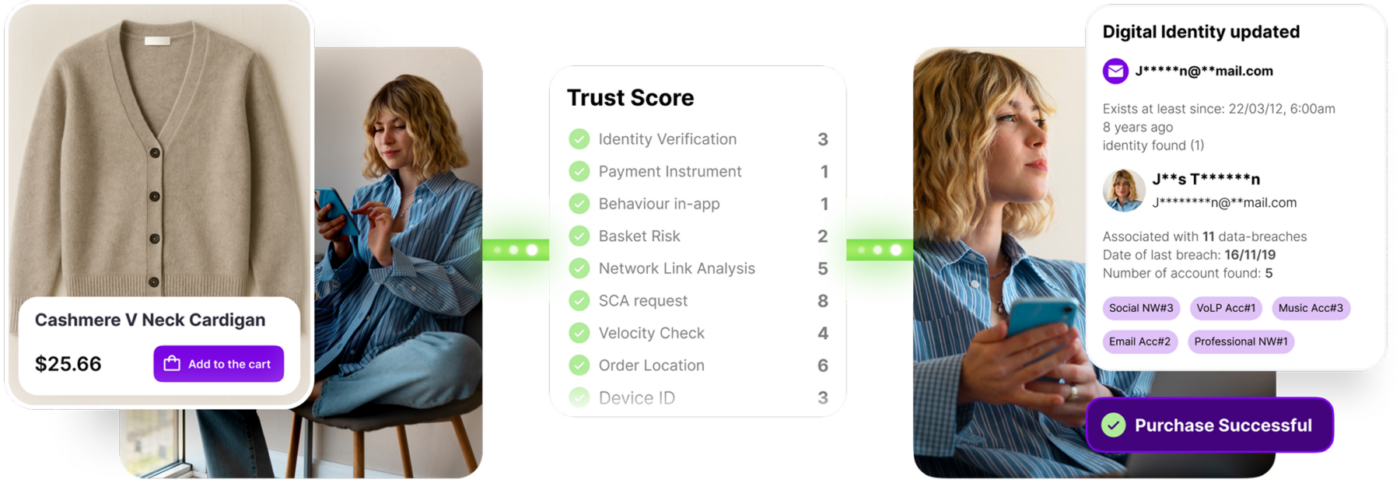

Oneytrust secures the full BNPL journey:

Real-Time Identity Verification

Behavioral analysis and device fingerprinting in milliseconds — before payment

authorization.

Synthetic Identity Detection

Access to over 15M verified profiles to flag risky or fabricated identities.

Cross-Merchant Pattern Analysis

AI models detect recurring fraud across multiple retailers.

Post-Purchase Monitoring

Identification of suspicious returns, chargebacks, or late-stage cancellations.

Oneytrust estimates that up to 6% of BNPL-approved transactions may be

fraudulent or end in default.

Protecting Good Customers While Blocking Bad Actors

The rise of Buy Now, Pay Later has been matched by a surge in fraud. BNPL now represents 7.1% of e-commerce payments in France. Fraudsters exploit the system using synthetic IDs, payment abandonment strategies, and complex return frauds.

- Smart Scoring Engine

Evaluates transactions in real time using multiple signals - 15M+ Verified Identities Database

Validates customers against an exclusive, trusted network - Cross-Merchant Pattern Detection

Flags coordinated attacks across retail network - Adaptive Rule Management

Adjusts detection logic to fit each BNPL provider’s risk profile

FAQ’s

Book a Demo to See BNPL Fraud Prevention in Action

Learn how Oneytrust protects BNPL payments while maintaining high

conversion rates.