“Thanks to Oneytrust, we were able to secure our subscription model from the start, ensuring our partners had reliable, creditworthy customers.”

Stéphane Richard

CEO of GreenLeaze

Why is fraud risk different in fintech

- Synthetic identities used to create fake accounts and default on payments

- Stolen credentials exploited by money mules or in account takeovers

- Fast onboarding processes that sometimes sacrifice security for speed

- Limited historical data, especially for new market entrants

- High user expectations for smooth, mobile-first experiences

Without rigorous digital identity checks, fraud can erode margins, damage brand trust, and threaten key partnerships.

Digital identity verification for secure growth

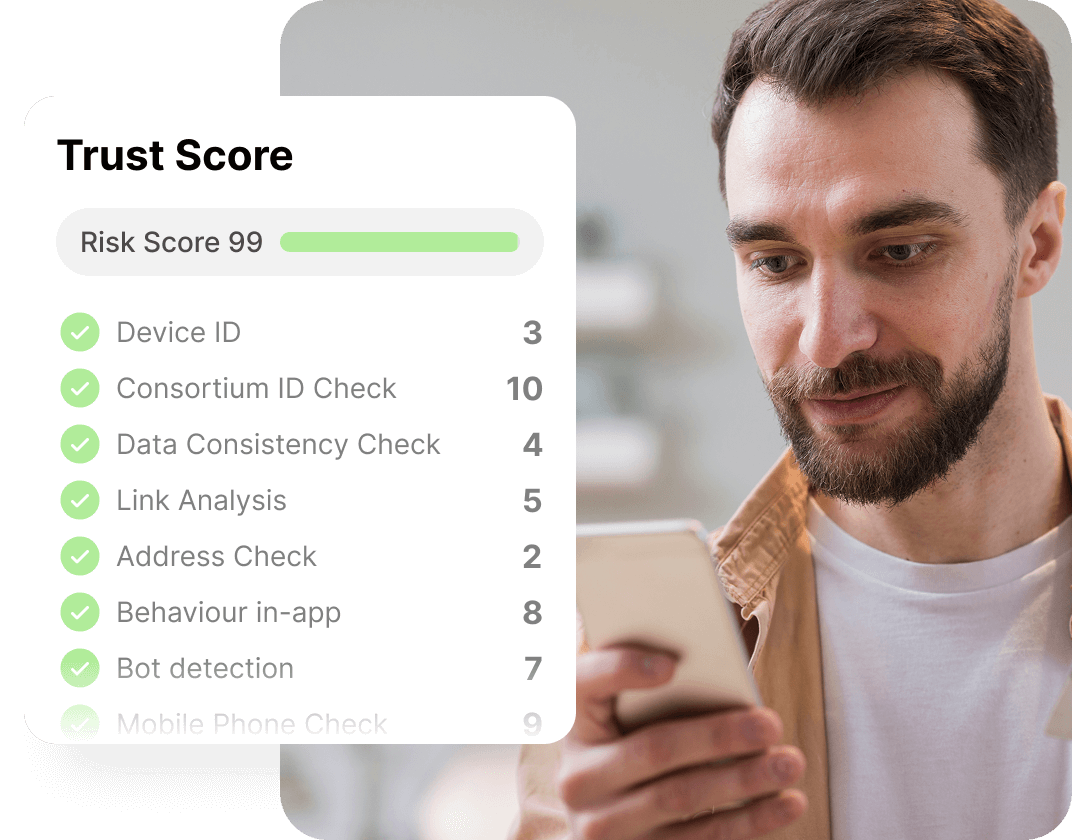

- Synthetic ID detection: Identifies fake profiles with no digital footprint

- Device fingerprinting & network analysis: Links identity to trusted devices and flags anomalies

- Real-time scoring: Automatically approves trustworthy users and flags suspicious ones

- Fast integration via our APIs

FAQ’s

Grow smarter with real trust

Stop fraud before it starts—without slowing down legitimate users. Discover how Oneytrust helps leading fintechs scale securely.