“With Oneytrust we were able to tackle the fraud rings that targeted our business, while still being able to expand our business internationally. We really appreciate the support of the team and value our partnership.”

FRÉDÉRIC MARECAILLE

Head of payment & fraud at Verbaudet

Industry Challenges

The Top Fraud Challenges for Digital subscriptions businesses

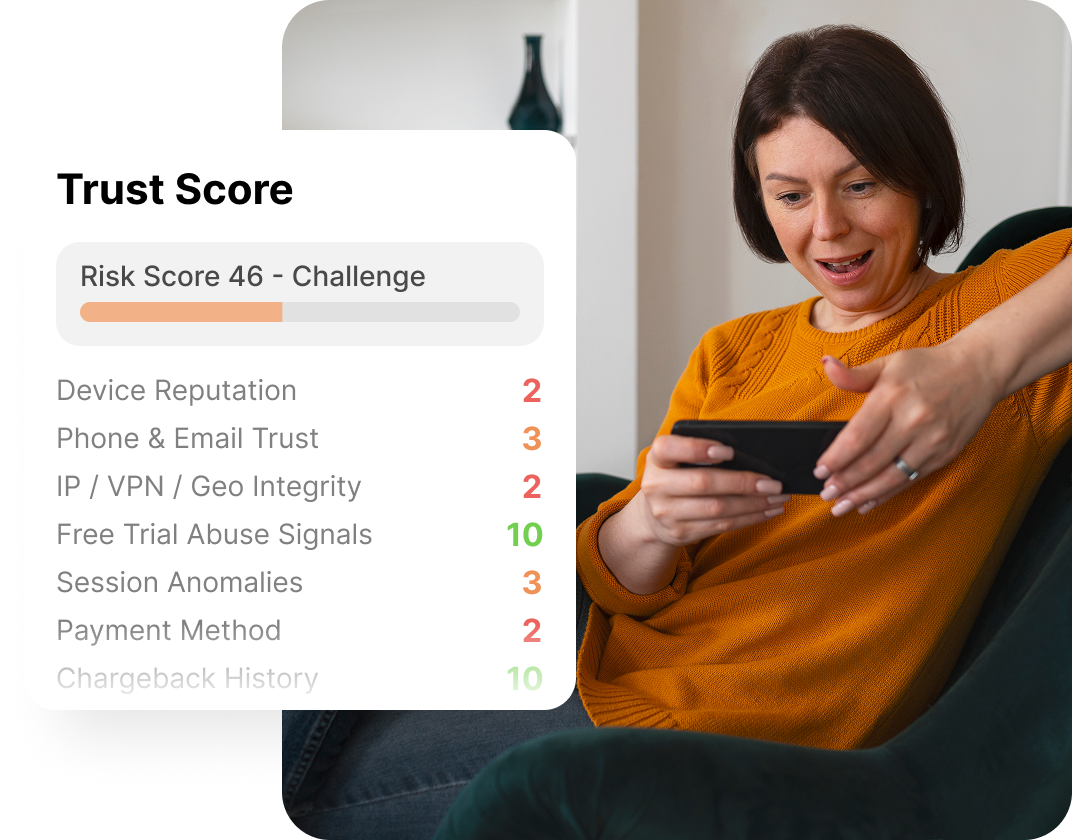

Relentless competition and attractive offers for new users leave digital businesses open to exploitation. Account security is key, and while robust onboarding is essential, continuous and automated identity and transactions checks are required with no undue impact on the user experience.

Key Threats:

- Free-trial & promo abuse:

Multi-accounting, burner emails/phones, device farms, VPN/geo spoofing - Account takeover & sharing:

Credential-stuffing, password recycling; multiple concurrent streams beyond policy - First-payment & renewals risk:

Friendly fraud on initial charge; disputes on renewals

How Oneytrust Stops Digital Subscriptions Services fraud

Oneytrust combines deep identity validation and lookups, device and behavioral signals with millions of validated identities to secure the key stages for any digital subscription business.

Key Features

FAQs: What digital subscription services

fraud experts are asking

See how Oneytrust can secure your subscriptions and accounts

Digital services businesses have unique challenges that require finely-tuned solutions

backed with real, local expertise. Talk to us about how we can keep fraud at bay.