Oneytrust.

Only trusted customers.

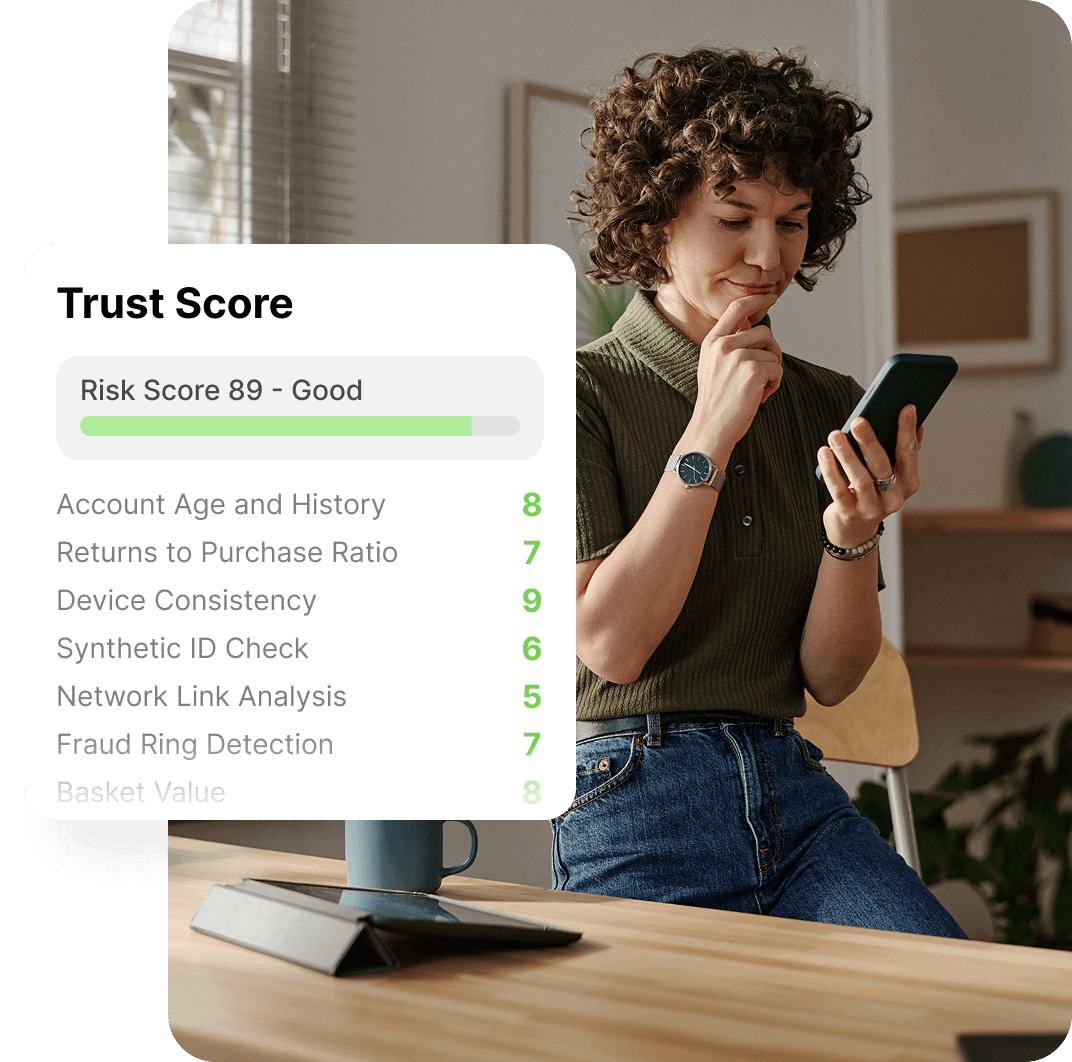

We help Europe’s leading retailers, banks and fintechs accept more customers and approve more transactions with minimal friction.

Our identity-first approach combines real-time signals, network intelligence and human expertise to keep journeys smooth and fraud losses in check.

We are proudly European and understand the complexities, nuances and regulations needed to trade successfully across our continent. Come talk to us.

Our DNA – the things we stand for

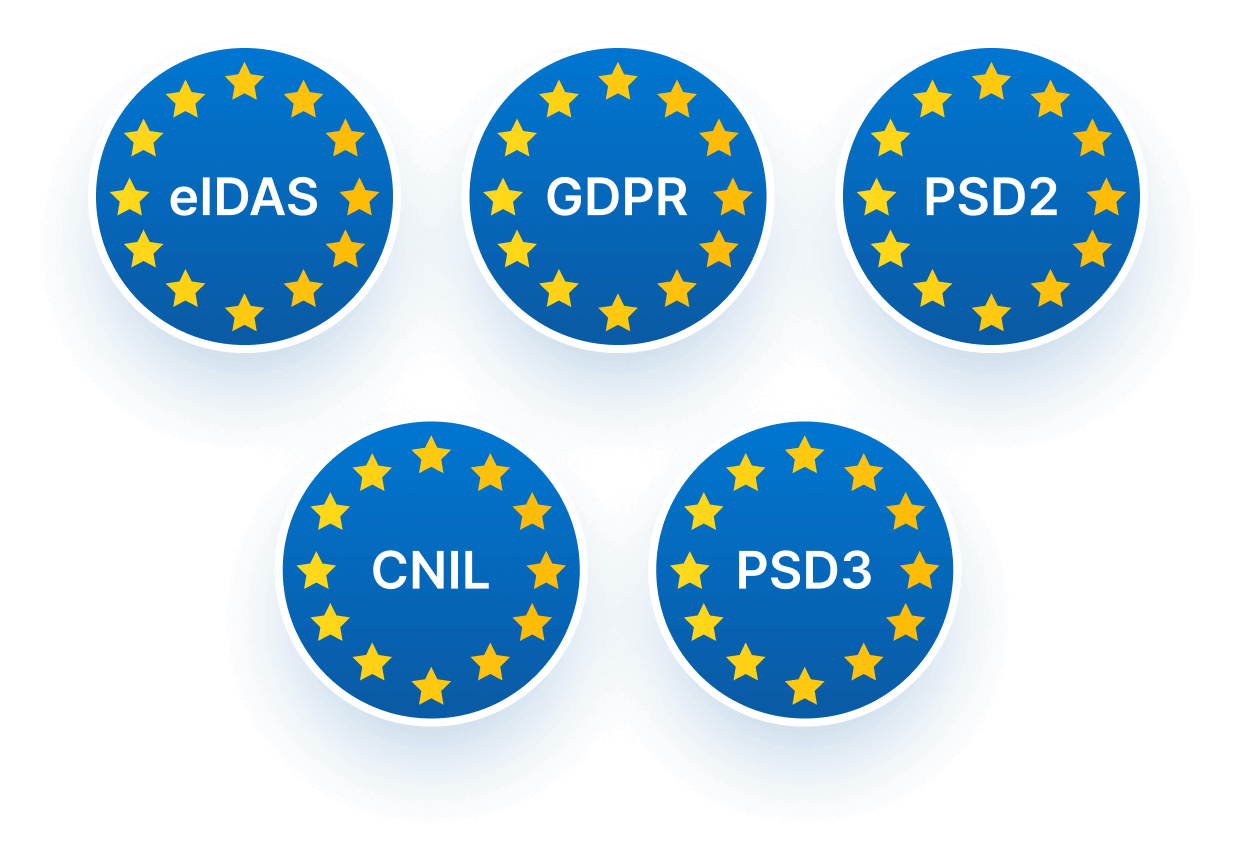

Compliant by design

We build with privacy and regulation in mind. Data privacy is not an afterthought. In France, we are CNIL-approved, which demonstrates how seriously we take our GDPR obligations.

We fully support PSD2 and are a reliable partner in supporting Strong Customer Authentication, with compliance within the eIDAS context.

Oneytrust is about community

Oneytrust friends, clients and partners came together to celebrate the company’s 25th anniversary.We are strong because of the bonds we build.

The Oneytrust support team. Meet our experts

We love using our leading technology to fight fraud. AI tools, graph networks, machine learning models, algorithmic predictions, and statistical analysis are all key parts of the fraud-fighting arsenal.

However, to be truly effective, the technology must be supported by onboarding specialists, integration engineers, fraud analysts, dark-web researchers, and success managers to ensure your business benefits to the maximum.

The Oneytrust Blog

Hear what fraud, identity and payments experts think of Oneytrust in a few words. Knowledge, integrity, service, savoir-faire. Are you in?

Subscribe to make sure you don’t miss out.